UK Gold Reserves

The UK holds large amounts of gold in reserve within the Bank of England’s secure underground vaults, which were built in the 1930s and cover an area of over 300,000 square feet. These vaults also hold gold reserves for a number of other countries around the world. They hold around a total of 400,000 gold bars, making them second in the world only to New York’s Federal reserve as the largest depository of gold. These state-of-the-art underground vaults are constructed using reinforced materials to protect from external threats. They feature the highest security measures to safeguard the gold, including twenty-four-hour monitoring by highly trained security officers, as well as high-tech surveillance systems and access controls.

As the UK followed the gold standard up until 1931, the UK kept a large amount of gold in reserve. Prior to WWII in 1939, a large amount of the UK’s gold reserves were shipped across the Atlantic to buy weapons.

Due to fear among British officials of Britain suffering the same fate as France after it was invaded by Nazi Germany, a secret operation known as ‘Operation Fish’ then saw 280 tonnes of UK gold transported from the Bank of England to be shipped to Canada and safely stored.

How much gold does the UK have?

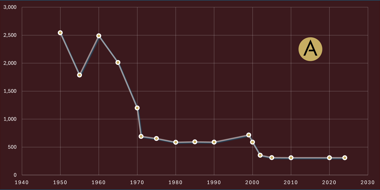

The table below shows the total amount of gold held in the United Kingdom's reserve from the peak year of 1950 to the year of 2024.

| Year | Gold Reserve (tonnes) |

|---|---|

| 1950 | 2,543 |

| 1955 | 1,788 |

| 1960 | 2,489 |

| 1965 | 2,012 |

| 1970 | 1,198 |

| 1971 | 690 |

| 1975 | 654 |

| 1980 | 586 |

| 1985 | 592 |

| 1990 | 589 |

| 1999 | 715 |

| 2000 | 588 |

| 2002 | 355 |

| 2005 | 312 |

| 2010 | 310 |

| 2020 | 310 |

| 2024 | 310 |

Why did the UK sell its gold reserves?

The year 1950 saw a record-breaking amount of gold held in reserve. However, it later declined and then was almost cut in half during a significant sale in 1970 to protect the Sterling exchange rate. The late 1990s saw a decision made by Chancellor of the Exchequer (and future Prime Minister) Gordon Brown to cut the UK’s reserves in half again over a period of three years.

Key events impacting UK gold reserves:

- 1950: Record high of 2,543 tonnes in UK gold reserves.

- 1970: Significant sale of gold reserves to protect the Sterling exchange rate, substantially reducing the total.

- Late 1990s: Chancellor of the Exchequer Gordon Brown initiates series of gold sales, beginning in 1999, which continued over several years. Gordon Brown’s decision to sell more than half of the UK’s gold reserves, totalling around 400 tonnes, was widely criticised as the sale was conducted at a time when the gold price was historically low and would impact the UK’s financial position. The price of gold skyrocketed a few years later.

How do UK gold reserves compare to other countries?

When examining global gold reserves, the UK’s holdings are significant but small compared to many other nations. The following table provides a comparison of the UK's gold reserves with those of other major global holders of gold, according to information from the World Gold Council, as of May 2024:

| Rank | Country | Gold Reserves (tonnes) |

|---|---|---|

| 1 | USA | 8,133.46 |

| 2 | Germany | 3,352.31 |

| 3 | Italy | 2,451.84 |

| 4 | France | 2,436.91 |

| 5 | Russia | 2,332.74 |

| 6 | China | 2,262.45 |

| 7 | Switzerland | 1,040.00 |

| 8 | Japan | 845.97 |

| 9 | India | 822.09 |

| 10 | Netherlands | 612.45 |

| 11 | Turkey | 570.30 |

| 12 | Taiwan | 422.38 |

| 13 | Portugal | 382.63 |

| 14 | Poland | 358.89 |

| 15 | Uzbekistan | 357.69 |

| 16 | Saudi Arabia | 323.07 |

| 17 | Kazakhstan | 310.62 |

| 18 | United Kingdom | 310.29 |

| 19 | Lebanon | 286.83 |

| 20 | Spain | 281.58 |

The United States holds the largest gold reserves globally, with the majority stored at the Federal Reserve Bank of New York, as well as Fort Knox. The total reserves of the USA are believed to be worth around £391 billion.

Germany is the second-largest holder of gold reserves, with a significant portion stored domestically as well as in foreign locations.

Italy has stockpiled slightly more gold than France, with its gold reserves held in Rome, as well as Switzerland, USA, and the Bank of England in the UK. Most of France’s reserves are believed to be held in vaults under the Banque de France, Paris.

The fifth largest holder of gold reserves is Russia. The nation, although heavily sanctioned, has boosted its reserves by around £30 billion in the past five years. Operating its own billion-dollar gold mining industry, Russia relies on domestic production and has no reliance on the importing of gold.

The UK may have the second largest vault after the New York Federal Reserve, and be a major importer and exporter of gold, but the nation is ranked eighteenth in the list of the largest holders of gold reserves, with around 310 tonnes. Despite historically significant gold reserves, including a peak of 2,543 tonnes in 1950, the UK's holdings have been reduced over the years due to sales initiated by the government, notably in the late 1990s under Chancellor Gordon Brown. However, with growing global economic uncertainty, these amounts could possibly increase in the future.

Our Most Popular Gold Products

This blog represents one person’s opinion only. Please note, gold and silver prices may go down as well as up. Atkinsons Bullion & Coins accepts no responsibility for any losses based on information we have provided. We do not offer investment advice. Please carry out your own research before making an investment decision.