Why Do People Buy Gold and Silver?

For thousands of years, gold and silver have been recognised as prize assets to own, and today is no exception. One of the most common questions we are asked by would-be investors is ‘why should I buy precious metals?’.

In this article we will cover the top reasons why many people choose gold and silver over other investments.

Why do gold and silver have value?

Gold and silver’s value derives from their ability to be exchanged. Simply put, they are a great form of money.

Historically, many other commodities have been used as a form of exchange, yet physical gold and silver have remained favoured due to specific benefits such as their scarcity, durability, malleability, and the fact that they are easy to transport.

Increasing demand

Global demand for both gold and silver is growing. Precious metals have been one of the best performing assets in the world over the last few years, thriving whilst many other industries have taken large hits. Demand is growing as many more of us are now seeing that it can be a positive addition to an investment portfolio.

With the world’s population growing, sooner or later demand meets supply, and eventually there is a possibility that it may not quite match up.

What are the benefits of buying gold and silver?

The most powerful reason why people choose to invest in precious metals is because they are well known for holding their value over time - especially in times of economic uncertainty and political instability.

Financial Protection

Investors use gold and/or silver to protect their wealth for the future. In times of economic uncertainty and mounting global debt, they are seen as a safe haven and used as a hedge against inflation, offering many advantages that other investments cannot. Holding physical gold and silver coins and bars can provide ultimate control over your own wealth, offering a timeless safeguard against financial crisis. They can be a way to preserve wealth for the future, and often passed on from one generation to the next.

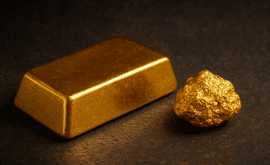

A Tangible Asset

Real physical gold and silver can be held in your hand. How many other investments can this be said about? Precious metals cannot be erased or wiped away unlike digital assets such as cryptocurrencies. An online hacker is not able to erase a gold Sovereign coin from existence, it will continue to sit in your pocket wherever you choose to go.

Practicality

Gold and silver are practical when it comes to both buying and selling. Both available as small coins and bars, these investments can then be easily stored and/or broken down and transported, to use as and when required.

Privacy

In these modern times, many investments now require the expertise of a third-party financial consultant or institution before you can access your investments. Purchasing precious metals can be done without any outside help, and you are able to access them as and when you choose.

Summary

In conclusion, it’s fair to say that each investor has their own reasons for looking to invest in precious metals.

Although the price fluctuates, gold and silver have proven to maintain their value over the long term, serving as a safe haven against inflation and the erosion of currencies. If you're looking for a convenient, flexible addition to your investment portfolio, then gold and silver coins or bars could be an investment well worth considering.

This blog represents one person’s opinion only. Please note, gold and silver prices may go down as well as up. Atkinsons Bullion & Coins accepts no responsibility for any losses based on information we have provided. We do not offer investment advice. Please carry out your own research before making an investment decision.