A Guide to Travelling with Gold

Can you travel with gold internationally?

Yes, you can travel with gold internationally, but there are some important things to consider. Each country has its own customs regulations, and thorough research before travelling is crucial to avoid any legal penalties or confiscation of your goods. Where some countries may require all gold to be declared for customs duties or security purposes, particularly when dealing with high-value amounts, others may not.

Tips:

- Research the regulations for your destination country before travelling.

- Ensure you adhere to customs rules to avoid penalties or confiscation.

Can you carry gold on an international flight?

It is generally acceptable to carry gold on an international flight, but restrictions will vary depending on the airline and destination. Many people choose to carry their gold bullion in their personal hand luggage rather than checked baggage, as this can reduce the risk of theft or damage. It is also a good idea to carry any documentation you have with you, such as invoices or receipts, to prove your ownership of the gold.

Key points:

- Check the customs regulations of your destination before travelling.

- Research airline security and baggage weight restrictions.

- Be prepared to explain the purpose of carrying gold if questioned by security personnel.

How much gold can you bring into the UK?

If you are bringing gold worth more than £10,000 into the UK, you must declare it to HMRC. You should also ensure that you have some documentation proving your ownership and the origin of the gold (such as receipts, invoices, or certificates). You must declare any goods exceeding your duty-free allowance or that you are planning to sell is a requirement, however, if the gold is a personal belonging or gift and within UK regulations, there should be no problems.

Key points:

- Declare items worth more than £10,000 to follow HMRC gold rules.

- Customs agents will determine whether taxes apply.

- Carry proof of ownership and origin of the precious metals.

Taking gold into the USA

The United States does not impose duty on gold bullion coins or bars, but you must declare them to a customs and border protection officer when entering the country. Gold valued over $10,000 will also require a completed declaration form. It is also crucial that you ensure you have all of the necessary documentation (receipts, invoices, or certificate of authenticity) to prove ownership of the gold bullion.

Key points:

- Declare all gold to customs upon arrival.

- No duty is imposed on gold bullion coins or bars.

- Documentation is essential for smooth transit.

How much gold can I carry to India from the UK?

Many people in the UK buy gold coins or gold bars to send to their relatives in India, particularly during wedding season, and India has some specific rules regarding gold imports. There is a 1kg weight limit per passenger, with extra import taxes and duties applied to any gold exceeding this limit. The amount of gold you can bring into India duty free also depends on the passenger's nationality and the duration of their stay, so it is essential to research the rules before travel.

All gold must be declared upon arrival in India. Regional laws may also apply, so consult local authorities for detailed requirements before travelling with your gold.

Travelling to the European Union with gold

When carrying gold coins or bars worth €10,000 or more, this must be declared at customs when entering or leaving an EU country. Although there are no internal border checks within the EU, carrying proof of purchase or ownership is still advised. Individual countries may also have specific requirements or limits, so it is suggested that you check these before travelling with your gold.

Key points:

- Declare gold valued at €10,000 or more.

- Check local customs regulations for individual EU countries.

- Carry proof of purchase or ownership.

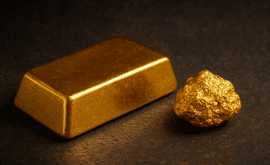

Travelling with gold coins and bars

When travelling with bullion, all the gold you carry is assessed based on its precious metal value, not its face value. For example, a 1oz gold Britannia coin has a legal face value (monetary denomination) of £100 but is worth significantly more based on its metal content. Customs agents will assess gold bullion based on its metal value, not its face value.

Tips for travelling:

- Carry proof of purchase/ownership.

- Transport gold in secure, lockable cases.

- Insure your gold for its full value during transit, ensuring the policy covers international travel.

- Be discreet when carrying gold coins and bars to ensure security.

Conclusion

Travelling with gold bullion requires some planning in order to ensure you are able to adhere to international and local regulations. It is crucial to research the specific rules for the countries you are travelling to and from to avoid any complications.

Disclaimer: This guide is for informational purposes only. Atkinsons Bullion & Coins accepts no responsibility for any losses caused by acting on this information. We do not offer advice on tax or customs regulations. Information is correct at the time of writing (December 2024). We always recommend conducting your own independent research for up-to-date information and rules before travelling with gold.

This blog represents one person’s opinion only. Please note, gold and silver prices may go down as well as up. Atkinsons Bullion & Coins accepts no responsibility for any losses based on information we have provided. We do not offer investment advice. Please carry out your own research before making an investment decision.