Why Does the Price of Gold Fluctuate Daily?

In this article, we will explore the reasons for the daily fluctuations in the price of gold, examining the factors influencing its value. From economic indicators to geopolitical events, we will delve into what affects gold prices, offering a deeper understanding of the precious metals market.

What affects gold prices?

A range of factors can impact the current price of gold, including:

Supply and demand

Gold prices are heavily influenced by supply and demand due to the metal being a finite resource. Any increase, decrease, or sudden change in the demand for gold will have an impact on its price.

On the supply side, factors such as mining output, central bank gold reserves, and manufacturing issues can have an impact on the availability of gold in the market. Meanwhile, demand for gold comes from a range of sources such as the jewellery market, industrial applications, and the investment market. Changes in consumer preferences, economic conditions, or investor sentiment can lead to fluctuations in demand, which can affect gold prices.

Economic indicators

The price of gold can be influenced by the stability of the global economy, with inflation rates and interest rates often playing a vital role in the demand for gold. During periods of economic uncertainty or inflationary pressure, investors often to seek to buy gold as a safe-haven asset, causing the price to rise. Historically, the price of gold has often risen when interest rates have fallen. Alternatively, when there is strong economic growth or interest rates are on the rise, the appeal of gold is not so strong, leading to a lower price.

Although studying the past performance of gold cannot guarantee the future performance of the precious metal, it can be a good indicator.

Currency strength

The value of gold is closely tied to the strength of currencies, particularly the US dollar since gold is primarily traded in dollars worldwide.

When the dollar weakens against other currencies, gold becomes more affordable for foreign investors, leading to increased demand and higher prices. However, a stronger dollar can make gold relatively more expensive, slowing demand for the precious metal and causing the gold price to decline.

Geopolitical tensions

Geopolitical events and global uncertainties have historically had a significant impact on the price of gold. Political instability, conflicts, and geopolitical tensions tend to heighten uncertainty among investors, prompting them to seek safe-haven assets like gold. Global events typically increase the demand for gold, which often pushes the price higher.

Market speculation

Speculative trading in the gold market can cause short-term price fluctuations in gold. Traders engage in futures contracts and options, based on their expectations of future price movements. This, along with how investors feel and speculate, can make gold prices change rapidly. As a result, speculation can often have a significant impact on day-to-day fluctuations in the gold price.

How is the price of gold determined?

In the UK, the official price of gold (known as the ‘gold fix’) is set twice a day at 10:30am and 3:00pm GMT, decided by the London Bullion Market Association (LBMA). Officially, the gold fix is used to decide contracts with members of the London Bullion Market but is also used unofficially as a benchmark to price gold across the world.

The LBMA takes many factors into consideration when deciding the price of gold for that day, including supply and demand, economic and political uncertainty, central bank buying and selling, and inflation levels.

The ‘spot price’ of gold constantly fluctuates throughout the day, in response to buying and selling activity by investors, central banks, and consumers from all over the world. This gold buying and selling activity is carried out by investors, central banks, and consumers from all over the world, which impacts upon the live spot price of gold.

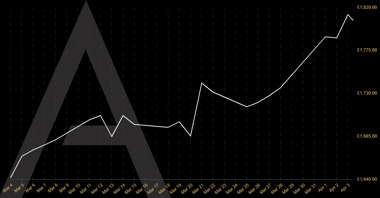

What is the price of gold today?

The live ‘spot price’ of gold fluctuates constantly. As it changes throughout the day, the live price is updated on our website every 60 seconds, ensuring you have the most accurate information on the latest gold price.

Our dynamic price chart provides the live, real-time spot price of gold in troy ounces for a range of currencies including GBP, USD, and EUR.

Will the gold price increase in the future?

Accurately predicting the future gold price is practically impossible, but considering a range of factors like economic indicators, global events, and market sentiment can sometimes offer a good indication. Looking at historical trends can also be informative, but cannot guarantee future outcomes. Historically, gold has maintained its value and often acted as a safe-haven asset during uncertain times.

In recent years, we have seen gold prices fluctuate due to factors like inflation worries, economic instability, and geopolitical tensions. Despite these ups and downs, the gold value over time has generally held strong, and has risen over the long term.

Looking forward to the future, economic recovery, government policies, currency changes, and geopolitical events will all impact gold prices. Additionally, investor sentiment and market speculation could possibly cause price movements.

While history suggests gold tends to hold its value over time, predicting future prices is not an exact science. Individuals looking to buy precious metals should research carefully, and possibly consider diversifying their portfolios based on their goals and risk tolerance.

This blog represents one person’s opinion only. Please note, gold and silver prices may go down as well as up. Atkinsons Bullion & Coins accepts no responsibility for any losses based on information we have provided. We do not offer investment advice. Please carry out your own research before making an investment decision.