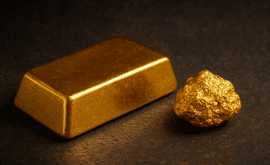

When Is the Best Time to Buy Gold?

In this article, we will look at some of the effective techniques and indicators that many successful investors use to help them make an informed decision about the best time to buy gold bullion.

How is the price of gold determined?

In the UK, the price of gold (known as the Gold Fix) is set twice each day at 10:30am and 3:00pm by the London Bullion Market Association (LBMA), with many factors taken into consideration when deciding the price, including supply and demand, economic and political uncertainty, central bank buying and selling, and inflation.

The spot price of gold also changes throughout the day, in response to buying and selling activity by investors, central banks, and consumers from all over the world.

Buying gold for profit

Some investors choose to invest in gold purely focusing on the fluctuations of the precious metal. This method of buying gold works on the basis of ‘buy low, sell high’, with the investor keeping a close eye on the news for announcements regarding economic or political instability in order to possibly anticipate which direction the precious metal may take in the future.

The price of gold historically tends to rise sharply in times of unforeseen economic or political turmoil, such as wars, pandemics, unexpected elections, or referendum results. These events often have a negative effect on the value of other investments such as stocks and property, as investors sell out and turn to gold as a safe haven to protect their money and cover any losses. This will then usually result in a positive knock-on effect on the gold price.

Alternatively, those times when the economic and political world appear to be more stable, the price of gold tends to steady, and even dip. This can provide an ideal opportunity for profit-seeking investors to add gold bullion to their investment portfolios, to think about selling when the price rises again.

Buying gold regularly for financial stability

Many investors choose to buy a small amount of gold regularly, to invest in their financial future, regardless of the current price of gold. This long-term investment strategy means putting away a little of what you can afford as savings for you and your family’s future, no matter your budget.

It is regarded as good practice to diversify the assets you have in your investment portfolio, and gold is often used to guard against value losses from other investments such as stocks or bonds, as it historically has been proven to hold value. Buying smaller units of gold, such as coins or small bars, has the advantage of your investment being easy to trade, store, and eventually to sell if or when that rainy day comes.

When is the right time to buy gold?

A good time to buy gold ultimately comes down to personal preference. Some investors may choose to invest in gold purely focusing on the fluctuations of the price of gold, buying when the price is low so they may make a profit when the price rises again. Others may choose to invest in gold regularly, buying small amounts of physical gold whenever they can in order to protect their wealth for the future.

A timeless safeguard

It’s important to remember that investing in gold coins and bars is about owning a tangible, secure asset which can provide ultimate control over your own wealth, without leaving it in the hands of the banks.

You should always consider your own individual financial needs, goals, and circumstances before going ahead and investing in bullion. If you buy this precious metal at the right time and make a good profit, that is a bonus. The main goal of investing in gold, however, is to ensure that you preserve your wealth for the future.

If you need any more information, or have any further questions about gold investment, please feel free to contact our team on 0121 355 0620 or send an email to info@atkinsonsbullion.com and we will be happy to talk with you about any queries you may have.

This blog represents one person’s opinion only. Please note, gold and silver prices may go down as well as up. Atkinsons Bullion & Coins accepts no responsibility for any losses based on information we have provided. We do not offer investment advice. Please carry out your own research before making an investment decision.