Will The Value of My Gold Investment Increase?

If you’re thinking about investing in gold bullion bars or coins, a key question you will most probably ask is whether the value of this asset will increase in the future.

In this article, we will guide you through the reasons for the fluctuating price of gold, and whether it is possible to forecast the direction that precious metals may take in the future.

Why does gold have value?

For thousands of years, gold has been recognised as a prize asset to own. Its story starts long before the stock markets launched, with records indicating that gold was mined and traded as far back as 550 BC. An asset of intrinsic value and a sign of wealth as far back as 4000 BC, gold has been linked with the powerful and wealthy and it’s safe to assume that gold has been traded for many millennia.

The price of gold tends to rise in times of economic crises and geopolitical instabilities as investors lose confidence in the banking system and other higher risk investments, and it is for this reason gold is often considered the ultimate safe-haven asset. Since the development of global stock markets, gold has also gained a reputation for having a positive correlation to inflation changes.

The fluctuating price of gold

In the UK, the official price of gold (known as the ‘Fix’) is set twice each day at 10:30am and 3:00pm. There are many factors that the LBMA takes into consideration when deciding the price, including supply and demand, economic and political uncertainty, central bank buying and selling, and inflation.

Throughout the day, the price of gold per gram changes in response to trading that takes place, via an anonymous auction every 45 seconds. Gold buying and selling activity by investors, central banks, and consumers from all over the world impacts upon the price of gold per gram.

Gold prices can fluctuate over 24 hours for a variety of reasons. Supply and demand, interest rates, currency value and inflation, and the level of economic uncertainty in the future all have an impact on the price of gold.

Will the value of gold increase?

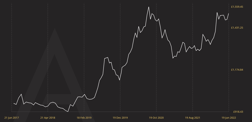

History shows that the value of gold has proven to increase in the long term. US monetary policy and inflation have historically been key factors for the gold price, and this is likely to continue. Over a five year period from June 2017 – June 2022, the price of gold rose by around 56%, and in the 20 year period between 2002 – 2022 it rose by over 640%.

While it may not constantly expel short-term dividends as the price fluctuates, gold has proven to provide a positive return on a longer-term basis in comparison to other assets. When compared with currency, owning £100 pounds worth of gold from 30 years ago would now be worth much more than the original investment. £100 cash is worth much less thanks to inflation.

The price of precious metals tends to rise in times of uncertainty, and decrease in more stable times, and looking at the historical movement of the price of gold can help us make predictions about which direction the precious metal may take, considering the state of the current economic and geopolitical climate.

The bottom line

The intrinsic value of gold never rises or falls. An ounce of gold or a gold sovereign will always be worth something because buying this precious metal means holding a form of money that has been a store of value for thousands of years.

Gold may not be an asset prone to large and quick price swings, but it is one that is known to be constantly growing.

History may tell us that the gold you own could likely increase in value over time, but it’s worth remembering that gold’s true purpose is for long term security, to protect yourself against financial uncertainties and take ultimate control over your own wealth. And that, is what gives gold its true value.

This blog represents one person’s opinion only. Please note, gold and silver prices may go down as well as up. Atkinsons Bullion & Coins accepts no responsibility for any losses based on information we have provided. We do not offer investment advice. Please carry out your own research before making an investment decision.