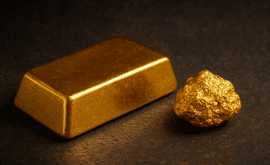

Is It Better to Buy Gold Coins or Bars?

Before investing in any type of asset, such as gold, it’s important that you do your research. Both gold bars and gold coins have their individual benefits, so it comes down to your circumstances and objectives when deciding to invest in either gold coins or gold bars.

This article will help you decide which type of physical gold to invest in, gold coins or gold bars? From what you should consider, to the advantages of investing in either of these types of physical gold, it will help ensure that the gold you buy is right for you.

Why should you invest in gold coins and bars?

In uncertain economic times, investing in gold can add stability to your portfolio. The precious metal has been used as a form of currency across the world for thousands of years, and investing in gold can be a good addition to your portfolio.

Buying physical gold coins and bars comes with plenty of benefits. The two main benefits of investing in gold is to protect and preserve your wealth, as well as adding diversity to the gold assets you already own. If you’ve owned gold bars and coins for a significant period of time and the price of gold goes up, you may be able to sell those assets off for a profit.

Things to consider before buying gold bars or gold coins

Before you decide to buy gold bars or gold coins, there are some things that you need to consider. Coins and bars are two of the most common types of gold that are bought by investors. It’s crucial that when you buy this precious metal that you buy it through a reputable dealer so that the gold you are buying is genuine.

If you are buying physical gold, such as bars or coins, you need to make sure that you have the a facility to store it. Having a place where you can store your gold assets can ensure that the coins and bars you own are secure from damage or theft. Some places where you can store your gold include a safe at home or paying someone to store it for you.

Another thing to take into account when investing in gold is the premium. Understanding what the gold spot price and premium is will help you decide how much you want to spend on your investment.

Pros of buying gold coins for investment

If you are looking into gold coin investment, this can come with many advantages. One benefit of old coins is that they are often more convenient than gold bullion bars. This makes it easier to sell gold coins in large quantities compared with selling a 1kg gold bar.

Smaller and more affordable than gold bars

One downside of buying gold bars in your investment portfolio is that they are often larger. Gold coins are usually significantly smaller and more affordable to purchase as part of your gold portfolio. By investing in this type of physical gold, you can have more flexibility and control over how you sell your coins in the gold market.

You don’t have to sell all your gold coin portfolio at once

Unlike large gold bars where you may have to sell the whole asset in your portfolio, buying small gold coins avoids that problem. Rather than selling all of your gold coin collection on the gold market, you can sell a few coins as you wish and keep hold of your other coin assets. It means that you can split your investment of gold coins into smaller chunks, which can be sold over time.

Coins often have aesthetic and collectable appeal

Unlike most gold bars, gold coins are often available in a range of sizes and feature attractive designs, appealing to both investors and collectors alike. They are also usually stamped with a date, which can also make them perfect to mark important dates such as birthdays and anniversaries.

Many coins have tax benefits

UK coins manufactured by The Royal Mint have the benefit of being exempt from Capital Gains Tax. This includes all gold Britannia coins, post 1837 sovereigns, and many more. You can make unlimited capital gains tax-free profit on investments of any value on these coins.

You can often sell a coin back at a higher price

The time may come when you decide to sell your coins or bars back to a bullion dealer for cash. When you decide it’s the right time for you to sell all or part of your bullion investment, some companies will often offer a higher price for a coin over a bar of the same weight.

You can see some of the prices we will currently pay for your coins and bars on our ‘Sell to Us’ page. Ask the Atkinsons Bullion team for guidance if you are unsure how to sell your gold coins and bars.

Pros of buying gold bars for investment

Alternatively, if gold coins are not part of your investment strategy, then you may consider buying gold bars. There are several advantages that come with this type of gold bullion over coins.

The main benefit of buying gold bars over coins is that they require little to no maintenance. Investing in other assets, such as a house, you need to make sure you continually update the asset to maintain its value. With gold bars, you can buy multiple assets and store them in a safe place over many years.

Small gold bars are easy to buy and sell

Buying and selling gold bars is straightforward whether you are a first-time or experienced investor. It’s sometimes worth investing in small gold bars over large bars as they can often be sold more quickly if you need to release capital.

You can decide to sell the small bars you have individually, giving you the flexibility to access cash, as well as preserve your portfolio.

Easily pass gold bars over to next generation

If you have regularly invested in gold, it can be easy to pass your assets over to the next generation of your family. By buying gold bars, it can safeguard your finances in the future, in case they need access to finance.

Gold bars have lower premiums

Higher production costs for coins, due to their shape and often attractive and collectable designs, means gold bars are often sold at lower premiums. When investing in a large quantity of gold, this can mean significant savings if you choose to buy bars.

Gold coins vs gold bars at a glance

| Category | Gold Coins | Gold Bars |

|---|---|---|

| Size | Gold coins are available in a variety of sizes and weights. | Gold bars are available in a wide range of sizes, from 1g up to 1kg. |

| Price per ounce | Gold coins can often carry higher premiums when compared to large bars due to production costs and collectable appeal. | Gold bars can often carry lower premiums on larger bars, due to lesser production costs. |

| Ease of storage | Gold coins are regarded as easy to store due to their small size. | Large gold bars can require more storage due to their size. However, they are considered to be a good way of storing large amounts of wealth in a small space. |

| Tax advantages | Gold coins are VAT free. Many UK gold coins such as the Britannia and the Sovereign are also exempt from Capital Gains Tax due to their legal tender status. | Gold bars are VAT free. |

| Flexibility | Gold coins' smaller size and lower price point can often make them easier to diversify when needed. | Larger sized bars are considered to be less flexible. Smaller sized bars are easier to diversify. |

| Collectable value | Gold coins can often feature interesting designs, historical importance, or low mintages that appeal to collectors, sometimes adding to their value. | Gold bars hold little collectable value and are traded exclusively for their gold content. |

Is it better to buy gold coins or bars?

If you're looking for a convenient, flexible addition to your investment portfolio, with capital gains tax benefits, then gold coins could be the best choice for you. If you're looking to make a larger investment and want to avoid paying a higher premium, then gold bars could be your best option.

The buying of gold coins and bars is an entirely personal decision, however, with many experts suggesting that a mixture of both is recommended in order to diversify your portfolio. Ask the Atkinsons Bullion team for guidance if you are unsure which coins or bars may be best for you.

If you are looking to invest in gold coins or gold bars, you can speak to our team of experts, who are on hand to answer any questions you may have about buying gold coins or bars.

Why Join Our Mailing List?

By signing up, you'll gain access to exclusive updates, early announcements, and tailored insights into the world of bullion and precious metals.

Latest Updates On Bullion

New Releases

Special Offers

Market Analysis

This blog represents one person’s opinion only. Please note, gold and silver prices may go down as well as up. Atkinsons Bullion & Coins accepts no responsibility for any losses based on information we have provided. We do not offer investment advice. Please carry out your own research before making an investment decision.