Gold vs Diamonds: Which Is Best For Investment?

There are many reasons as to why people decide to invest in assets such as gold, shares, property and jewellery in order to protect their wealth for the future. Which asset you choose depends on what you are looking to gain from the investment itself, as each offer their own unique benefits and drawbacks. Both a tangible asset of considerable value, in this article we’ll be looking at the pros and cons of investing in gold versus diamonds.

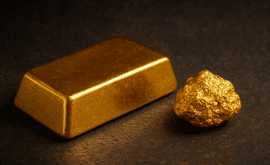

Investing in gold

A core reason why many choose to invest in any asset is to protect their wealth against economic fluctuations. Gold has always held intrinsic value for three main reasons: it is virtually indestructible and able to take practically any form, humans find it psychologically attractive, plus it is extremely scarce.

Gold is often used as a hedge against rising inflation, unlike other commodities. This precious metal is often seen as a safer bet for investment purposes during unstable political and economic situations as, unlike fiat currency, gold tends to hold its value over the long term.

Physical gold coins and bars are growing in popularity as a way to preserve wealth for the future and are easily transported and traded, or passed on from one generation to the next.

Investing in diamonds

Like gold, diamonds are known for their high value and prestige. Although not as scarce as gold, the value of diamonds is, in part, driven by the demand for them across the world. Another tangible asset, they are also easily transported and stored. Determining factors of a diamond's price is its weight, cut, and clarity. Natural diamonds are used as a store of investment as they are rare, durable, and can be passed on through generations.

Which is best for investment: gold or diamonds?

Gold is often regarded the better investment option over diamonds, as this precious metal is more easily traded and is often viewed as a currency with a stable, increasing value over the long term. Diamonds are often more volatile as their value relies purely on their weight, cut, clarity, and colour.

Gold is easier to trade than diamonds. Assets are a great way of protecting wealth but selling them back to liquidate funds is always a key consideration when investing. This is where diamond investments can present a serious drawback. A fair amount of knowledge about diamonds is required to invest in them successfully due to the huge number of varieties and differences that only an expert would be able to identify. Gold can not only be easily sold almost instantly, but little knowledge about this precious metal is required to invest in the asset, and more information is widely available on the product.

Diamonds are highly coveted globally, and we often see them worn by celebrities and other wealthy people in the public eye. Some choose to invest in diamonds in order to wear them as a status symbol of wealth and power. However, this can lead to damage or even theft, meaning your diamonds may depreciate in value. This is a problem not encountered as often for gold investors, whose investment more than likely stays tucked away in a safe, hidden from the rest of the world until it is needed.

Which is more valuable, gold or diamonds?

There is no set live gold price for either gold or diamonds as the demand for both of these assets is constantly fluctuating. Gold is regarded as a safe investment that is often used as a hedge against inflation, and can be used as a form of currency, which is not the case for diamonds, meaning that gold could be worth more than diamonds.

If you are considering investing in gold bars or coins, our team have the knowledge and experience to assist you in your investment journey. Whether buying or selling your precious metals, Atkinsons Bullion make it easy to invest. If you need any more information about gold and silver investment, please feel free to contact our team on 0121 355 0620 or send an email to info@atkinsonsbullion.com.

Why Join Our Mailing List?

By signing up, you'll gain access to exclusive updates, early announcements, and tailored insights into the world of bullion and precious metals.

Latest Updates On Bullion

New Releases

Special Offers

Market Analysis

This blog represents one person’s opinion only. Please note, gold and silver prices may go down as well as up. Atkinsons Bullion & Coins accepts no responsibility for any losses based on information we have provided. We do not offer investment advice. Please carry out your own research before making an investment decision.