Would the Gold Standard Work Today?

"We have gold because we cannot trust governments," President Hoover famously said in his statement to Franklin D. Roosevelt in 1933.

President Donald Trump made numerous statements in the past about reverting to the ‘Gold Standard’. But what exactly is the gold standard? And would it really be practical to rebuild an international gold standard?

What is the gold standard?

The gold standard is a monetary system where a country’s unit of currency is kept at the value of a fixed amount of gold. Countries that use the gold standard set a fixed gold price which is then used to determine the value of the currency. For example, if the UK set the gold price at £900 an ounce, the value of the pound would be 1/900th of an ounce of gold.

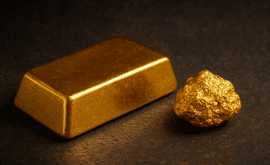

The allure of gold is nothing new. Throughout history, gold has often been the currency of choice. After the gold rush in America, worldwide commerce was becoming more unified and countries were looking to create a ‘world market’, and, as a result, the gold standard was put into operation. This meant that citizens no longer had to carry around gold bullion and coins and could handle transactions with the corresponding value in paper money.

In the UK, the gold standard was put into place in 1821. This then meant that the Bank of England was obligated to exchange gold for pounds at the specified rate. Other countries then followed suit, along with the USA in 1873.

However, the gold standard faced challenges during times of economic turmoil. Flaws in the system, showing its inability to hold during both good and troubled times, became apparent. To stabilise currency values, the US Congress created the Federal Reserve in 1913. But the outbreak of World War I disrupted this stability. To finance the conflict, countries resorted to printing money, leading to hyperinflation.

The situation worsened after the 1929 stock market crash, causing the price of gold to soar as people hoarded the precious metal. Eventually, confidence in the gold standard waned, and it was abandoned in the UK in 1931. The US followed suit in 1933 with the Gold Reserve Act, effectively ending the gold standard domestically. Although remnants of the gold standard persisted internationally under the Bretton Woods system until 1971, the complete abandonment marked a shift away from the gold-backed currency system.

Advantages of the gold standard

- Price stability: Under the gold standard, prices tend to be more stable as the money supply is tied to the amount of gold available, which limits inflation.

- Controls government spending: Since the government cannot print more money at will, it is forced to keep its spending in check, preventing substantial amounts of debt.

- Positive for international trade: The gold standard makes easier international trade easier, as currencies are pegged to a fixed amount of gold, providing a fixed pattern of exchange rates, and creating certainty in international trade.

- Long-term economic stability: Historically, economies under the gold standard have seen long-term stability and growth, as it encourages smarter money decisions.

- Confidence in currency: Gold backing can instill confidence in the currency, as it represents a tangible asset of value, reducing the risk of the devaluation of currencies.

- Prevention of large economy crashes: With a limited money supply tied to gold reserves, the gold standard helps prevent large crashes in the economy by stopping too much money being created, promoting more sustainable economic growth.

- Encouraging growth: Since there is a limit on how much cash can be made, there is an incentive for businesses to invest in future technology and production in order to help the economy grow, rather than relying on monetary expansion.

Disadvantages of the gold standard

- Vulnerability to shocks: Since the value of money is tied to gold, any shock to the gold supply, such as a sudden discovery of new gold deposits, can disrupt the economy. A large sudden spike in demand for gold could impose great costs on the economy.

- Limited economic independence: Countries under the gold standard may find it challenging to isolate their economy from economic fluctuations, potentially resulting in becoming tied to another nation experiencing inflation or depression.

- Limited flexibility: The gold standard ties the amount of money a country can have, to how much gold it owns, which can limit the government's ability to respond to economic changes.

- Restricts government action: Governments cannot easily increase the money supply during economic downturns in order to stimulate growth or provide relief.

- Constraints on trade: Tying currencies to gold can make international trade more difficult, especially if the supply of gold does not match the needs of the growing economy.

- Risk of deflation: If the supply of gold is not able to keep up with economic growth, it can lead to deflation, resulting in a drop in prices and struggling businesses.

- Limited economic expansion: Some argue that the gold standard can hold back economic growth as it restricts the amount of money available for investment and spending.

Should the gold standard be restored?

During times of instability, it is common to hear talk of implementing another gold standard. Restoring the gold standard could present both benefits and challenges when considered against alternatives like fiat currency. Historically, the gold standard has offered stability by curbing inflation and encouraging government spending responsibility. However, it is not system without its flaws. Its rigid nature can hinder a government's ability to respond swiftly to critical economic events like recessions.

In today's economy, the gold standard's limitations may outweigh its advantages. Globalisation has interconnected economies, meaning that a country's economic fortunes can often be influenced by external factors. The gold standard's inability to adapt to fluctuating economic conditions could leave countries vulnerable to shocks, hinder their ability to stimulate growth during downturns, and result in a more volatile economy.

Gold has a long-standing relationship with currency. Today, the price of gold is determined by a range of factors, including demand for the precious metal, and although is no longer used as a standard, it still serves many functions. Gold can be used as a hedge against inflation, and is often regarded as a safe haven, offering many advantages that other assets cannot.

Upon considering whether the gold standard should be restored today, and if it would work at all in today’s dynamic economy, would depend on a balance between stability and flexibility. Consideration would need to be made on how the world economy works and making sure our monetary policies can handle challenges and support growth. It is reported that economists and bankers are largely against the idea of returning to a gold standard.

This blog represents one person’s opinion only. Please note, gold and silver prices may go down as well as up. Atkinsons Bullion & Coins accepts no responsibility for any losses based on information we have provided. We do not offer investment advice. Please carry out your own research before making an investment decision.