Why Does Physical Gold and Silver Cost More Than The Spot Price?

The spot price

‘Spot’ is the term used in the precious metals market for the current price for 1oz of gold or silver. This price changes minute-by-minute throughout the day, fluctuating with the world market, and is a standard used by precious metal dealers around the world to set their premium prices in order to sell to their customers. Most online bullion dealers host the live spot prices in real time on their website.

Our dynamic price charts provide real-time updates every minute, ensuring you have accurate information on the current spot prices. See the current gold price, or check the silver rate today easily at your convenience.

It is nearly impossible to buy gold and silver at spot, as traders will always charge a premium over the spot price. The spot price does not account for the other costs associated with the sale or purchase of gold and silver - and understanding this is important as investors will naturally want to purchase their metals as close to spot as they possibly can.

Why does physical gold and silver cost more than the spot price?

Premiums are added onto the spot price of gold for a variety of reasons. These are usually due to the costs associated with the acquiring, and manufacturing of the metals. The gold and silver bullion dealer must also make a profit. A bullion dealer will always have costs associated with running a business including; labour, storage, shipping, office & warehouse expenses, marketing, customer service, and other costs.

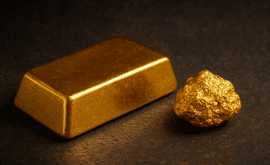

Refining and creating a bar or coin adds to the cost you will pay for the product. A bullion coin is more than a lump of raw gold or silver – there are costs involved in the creation of your beautiful Sovereigns and Britannia coins.

Another factor to consider is the supply chain. Bullion coins and bars are usually manufactured by a government or private mint who will then sell their product on to a dealer. Some bullion dealers are able to buy directly from these mints and can then sell on their product at a lower premium. However, some dealers cannot, and so must purchase from an authorised distributor, which adds a middleman to the process, and therefore another cost.

Growing demand and supply disruption can also impact the spread between spot and physical prices.

Why do some branded bullion products differ in price?

Here at Atkinsons, we offer volume pricing on many of our gold and silver coins and bars which can help you save money when buying a larger quantity. You may notice that some products of the same weight may be priced differently to others. The simple reason for this is that some brands may have higher manufacturing costs, or simply charge a higher premium for their products than others. Some of our clients may choose to pay a little more for a product from a brand they are more familiar with, however others may decide to choose the cheaper option. Either way, its worth remembering that bullion products are typically valued by the weight and purity of the precious metal, and not the brand.

How can I save money when buying gold and silver?

Do your homework

The industry of buying and selling of precious metals is highly competitive, and dealers will often compete for business by selling at a lower premium than their competitors, so it’s always worth doing your research. Be sure to not only check prices, but also whether you need to factor in the cost of delivery - or if the dealer offers free insured shipping (as we do). Ensure you also check reviews etc. to ensure you are shopping with a retailer you can trust.

Know what you want to buy

Are you interested in buying coins or bars? If you are interested in investing for purely the value of the gold and silver only, and not for the collectable or numismatic value, you may consider buying bars over coins. Bars are usually cheaper due to less expenses that go into creating and minting a bar than a coin. If you are looking for a convenient, flexible addition to your investment portfolio, with tax benefits, then you may consider buying coins over bars.

Consider pre-owned

Buying second-hand coins or bars can save investors a considerable amount of money. These bullion items are often sold at a discounted premium compared to brand new ones and are quite often in excellent condition.

Buy in bulk & check for deals

It’s always worth checking for promotions and deals! Here at Atkinsons we offer volume pricing on many of our gold and silver coins and bars which can help you save money when buying a larger quantity. A wide range of money-saving bundles are also available to choose from in our special offers section.

The bottom line

It is normal to pay over the spot price for gold or silver, but a wise buyer who has done their research before they buy is able to make the best decision for their own needs.

Economic pressures such as rising inflation have seen precious metals become one of the best performing assets in the world over the last few years, thriving whilst many other industries have taken huge hits. Spot prices fluctuate, however gold and silver have proven to maintain their value over the long term, often serving as a safe haven for investors who wish to take ultimate control over their own wealth.

If you are looking to invest in precious metals, Atkinsons have specialised in the buying and selling of gold and silver for over 30 years. For more information, please feel free to call and speak to a member of our knowledgeable team on 0121 355 0620 or email us at info@atkinsonsbullion.com.

Why Join Our Mailing List?

By signing up, you'll gain access to exclusive updates, early announcements, and tailored insights into the world of bullion and precious metals.

Latest Updates On Bullion

New Releases

Special Offers

Market Analysis

This blog represents one person’s opinion only. Please note, gold and silver prices may go down as well as up. Atkinsons Bullion & Coins accepts no responsibility for any losses based on information we have provided. We do not offer investment advice. Please carry out your own research before making an investment decision.