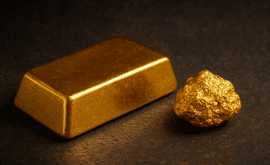

Can I Buy and Sell Precious Metals Without Paying Tax?

What is Capital Gains Tax?

Capital Gains Tax (CGT) is a tax applied on the profit when you sell, give away, or dispose of an asset you own that has increased in value. This includes assets such as shares, bullion, and real estate property.

CGT is payable if an individual makes over a certain amount of profit in one financial year, and is taxed on the gain that is made, not the total amount of money that is received. The tax rate payable can vary and is displayed in full on the HMRC website.

What is Value Added Tax?

Value Added Tax (VAT) is a tax of 20% that is charged on most goods and services in the UK.

What is Inheritance Tax?

Inheritance tax is tax paid to HMRC on the value of someone’s estate once they pass. A person’s estate consists of any property, money, and possessions left behind. There are, however, predefined thresholds in place whereby anything under that value qualifies as being tax-exempt.

There is usually no inheritance tax to pay if the value of a person’s estate is valued at less than £325,000.

Are all gold and silver products taxed?

In the UK, the taxation of gold and silver products can vary depending on the type of product, as well as specific tax regulations. Here, we will examine how Value Added Tax (VAT) and Capital Gains Tax (CGT) apply to gold and silver coins and bars:

Value Added Tax (VAT)

Gold: Most gold bullion products are exempt from VAT.

Silver: Unlike gold, silver is subject to VAT. All new silver coins and bars are subject to the standard rate of VAT at 20%.

Capital Gains Tax (CGT)

Gold: Gold coins that are considered legal tender in the UK, such as the Britannia and the Sovereign, are exempt from CGT. This makes them an attractive option for those looking to avoid additional tax on any gains when the time comes to sell your gold. However, other gold products that are not UK legal tender, such as non-UK coins and gold bars may be subject to CGT upon selling, if the gains exceed the annual allowance.

Silver: As with gold coins, those silver coins that are considered legal tender in the UK, such as the silver Britannia coin, are exempt from CGT upon selling. Silver bars and non-legal tender silver coins are subject to CGT if the profits from selling these silver products exceed the annual CGT allowance, so the investor will have to pay CGT on the excess amount.

Can I buy and sell gold and silver without paying tax?

It is possible to buy and sell gold and silver without paying certain taxes by selecting specific types of coins. UK individuals can avoid paying Capital Gains Tax (CGT) on their gold and silver by purchasing coins produced by The Royal Mint that qualify as UK legal tender, regardless of how much they may increase in value.

Capital Gains Tax (CGT) exemptions:

- Gold Britannia Coins: These coins are considered legal tender and are exempt from CGT. This exemption means that any gains made from the sale of these coins is not subject to tax.

- Gold Sovereign Coins: Post-1837 Sovereigns are also British legal tender and benefit from the same CGT exemption, making them a tax-efficient choice.

- Queen’s Beasts and Tudor Beasts Coins: All coins in these series’, produced by The Royal Mint, are recognised as legal tender and is not subject to CGT on any gains made from their sale.

- Silver Britannia Coins: Like their gold counterparts, these silver coins are British legal tender and exempt from CGT. This allows for potential gains to be made without tax implications.

- Other UK Legal Tender Silver Coins: Like the Britannia series, other silver coins produced by The Royal Mint that qualify as legal tender, such as silver £1 coins, £2 coins, and silver crowns are also free from CGT.

These exemptions apply regardless of how much the value of these coins may increase over time. By choosing coins that are classed as British legal currency, individuals can trade in gold and silver without worrying about paying Capital Gains Tax on any profits made when the time comes to sell.

Value Added Tax (VAT) exemptions:

- Gold coins: In the UK, all gold classed as ‘investment gold’ is exempt from VAT. This includes gold coins that meet certain purity standards (minimum 90% for coins) and are traded based on the market value of their gold content rather than their face value. Popular gold coins like the Britannia, Sovereign, and Krugerrand all fall into this category and are not subject to VAT.

- Gold bars: All gold bars that are at least 99.5% pure gold are exempt from VAT.

Is gold and silver exempt from inheritance tax?

Buying and collecting precious metals can be a tax-efficient and practical way of transferring wealth to loved ones, particularly after death, but gold and silver are not fully exempt from inheritance tax. However, there are some significant tax benefits to transferring your wealth this way. If you decide to collect gold or silver coins produced by The Royal Mint, they will be exempt from both CGT and VAT, meaning that whoever you pass them on to will be able to sell them without incurring any tax costs.

Additionally, many people thinking about how best to transfer their wealth without incurring stinging HMRC fees often also choose to give gold or silver coins as presents whilst still alive. Giving these as Christmas or birthday gifts allow some wealth to be distributed using the annual inheritance gift allowance.

Can I buy VAT-free silver?

Individuals can avoid paying VAT on many pre-owned silver coins, due to the Margin Scheme. This scheme, run by HMRC, allows us to re-sell second-hand silver coins that we have bought from the public without passing on any VAT to the client. The VAT is paid by us on the profit that we make from the sale of these coins.

Clients can pick up some great deals with these VAT-free silver coins, especially if these coins are also exempt from CGT. The lack of VAT can make a big difference to the retail price, meaning savings for silver stackers, and they tend to sell out quickly due to their popularity with our clients. However, they are updated constantly so it is a good idea to keep checking back.

Any other silver, including new silver coins, and all silver bars and rounds, are subject to VAT at the standard rate of 20%.

Buying tax-free gold and silver

For those looking to gain profits from their precious metals, opting for gold and silver coins that are exempt from Capital Gains Tax (CGT) and Value Added Tax (VAT) can offer big advantages. While some gold bars may appear to be less expensive than gold coins at first, gold Britannia coins, for instance, are CGT exempt, meaning any profit you may make from selling them would not be taxed. The same applies to post-1837 gold Sovereigns and the Queen’s Beasts and Tudor Beasts coins.

Silver Britannia coins are also CGT exempt. However, it is important to remember that while most investment gold is not subject to VAT, silver coins and bars usually are. So, when you are buying silver, it is a good idea to think about how 20% VAT may affect the overall cost.

To find tax-free products, look for clear markings on our website. All our product listings include VAT information. Choosing CGT exempt and VAT-free coins can help you build a tax-efficient precious metal collection, maximising your potential profits over time.

Why Join Our Mailing List?

By signing up, you'll gain access to exclusive updates, early announcements, and tailored insights into the world of bullion and precious metals.

Latest Updates On Bullion

New Releases

Special Offers

Market Analysis

This blog represents one person’s opinion only. Please note, gold and silver prices may go down as well as up. Atkinsons Bullion & Coins accepts no responsibility for any losses based on information we have provided. We do not offer investment advice. Please carry out your own research before making an investment decision.